Partners provide a package for ag enterprises to flourish

Small ag enterprises face several barriers to expansion. A partnership in Bangladesh aims to put them on the route to growth. Our Foundation plays a big role.

Bangladesh is a primarily agrarian country. Agriculture contributes about 20% to GDP and employs some 45% of the workforce. Approximately 80% of the agricultural workforce are employed in small and medium-sized enterprises (SMEs). Many such organizations suffer from a lack of useful services and suitable incentives. Agri-SMEs receive little market-relevant business development support, practical opportunities to accelerate growth, or opportunities to link with growth-orientated funding opportunities. They are often unaware of the latest ag-tech, have minimal understanding of market dynamics and survive on extractive business strategies. Many young people are not interested in getting involved.

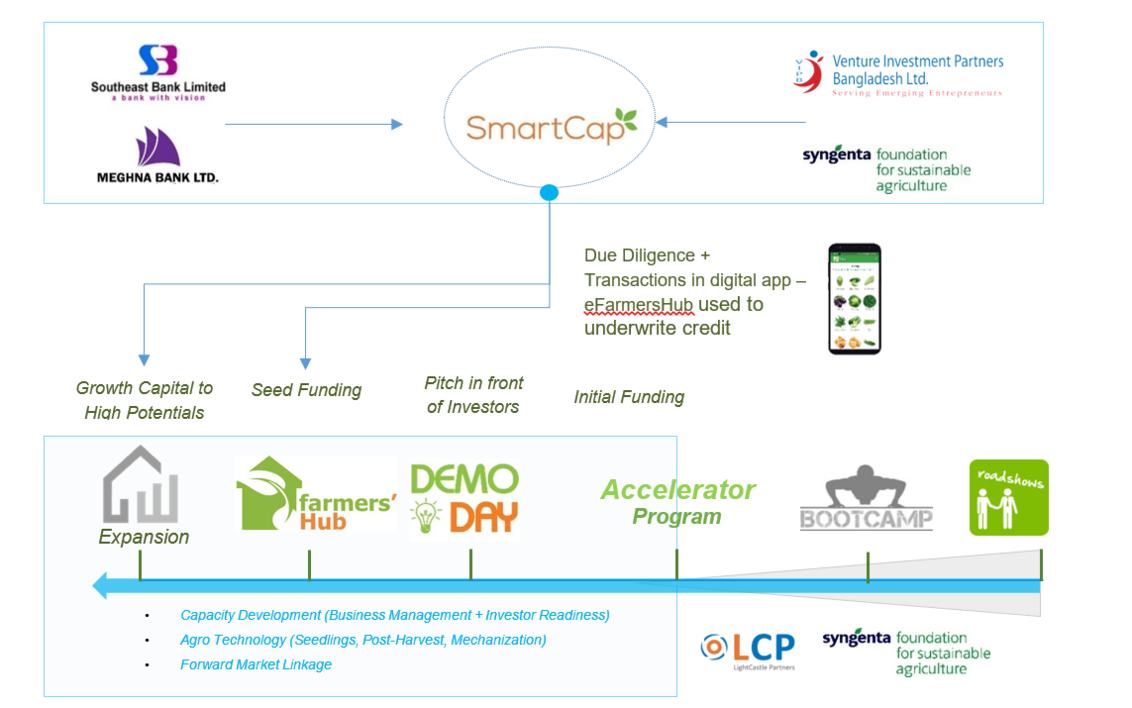

Our Foundation (SFSA Bangladesh), LightCastle Partners (LCP) and Venture Investment Partners Bangladesh Limited (VIPB) want to improve this situation. Together we designed the SmartCap initiative: ‘Transforming SMEs into Growth-Oriented Business Ventures’. This is the first Smart Capital Impact Fund in Bangladesh for Agri-SMEs’ development and sustainability. UKAid is funding the work as part of its program “Business Finance for the Poor in Bangladesh (BFP-B)”.

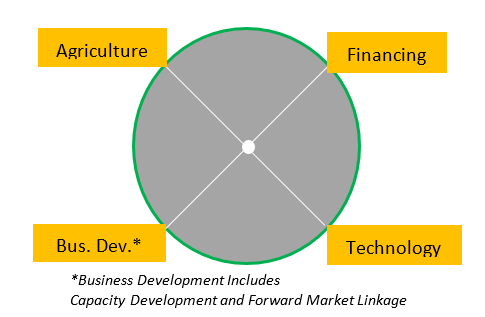

“SmartCap transforms SMEs into growth-oriented ventures”, says our Country Director Farhad Zamil. “As its name suggests, the program provides expansion capital, by which we mean ‘patient’ risk capital, not the short-term ‘working’ type. SmartCap also provides capacity development, agro-technology like seedlings and mechanization, as well as forward market links. It equips SMEs with the innovative Farmers’ Hub business model, a marketplace for both inputs and outputs. The necessary capital comes from equity or quasi-equity instruments and enables the SMEs to grow considerably larger.”

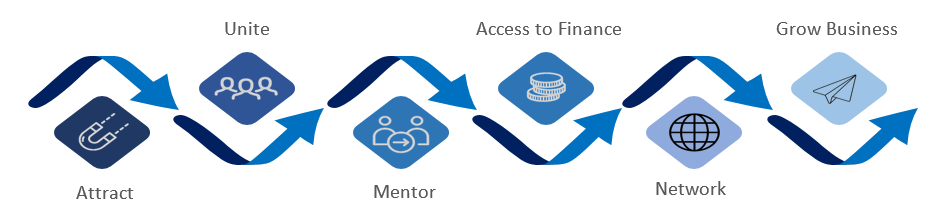

Work started in April 2018. The SmartCap partners reached out to over 600 entrepreneurs. The best 60 received mentorship, networking and access to finance. “We followed a systematic process to ensure the participants got qualified in business and were able to become successful larger entrepreneurs”, Farhad explains.

The program included seven key activities. Roadshows invited entrepreneurs to participate in Bootcamps, at which selected entrepreneurs were shortlisted for the ‘Accelerator’. This month-long residential course lined them up with Farmers’ Hubs and seed funding. The entrepreneurs graduated at a Demo Day which included a pitch to impact investors and banks. Over the following six to nine months, performance monitoring helped secure further rounds of financing. The seventh activity was then credit underwriting, enabling a commercial bank to invest through venture capital.

“The three program partners split the work up well”, Farhad reports. “LCP played a central role in entrepreneur selection and the Accelerator. We took care of Farmers’ Hub management, market links, and innovations; VIPB’s focus was on investor link-ups, capital-raising and investment.”

SmartCap used the SFSA agri-business management tool eFarmersHub to link the 60 entrepreneurs with three commercial banks. More than half of the entrepreneurs also got a venture capital commitment. SFSA and its partners now aim to raise an impact fund of up to $20m over three years and develop more than 800 Farmers’ Hubs across Bangladesh